Why do startup’s benefit from early relationships with a CPA firm?

Startup ventures face unique financial challenges beyond basic bookkeeping and tax filing requirements. These emerging businesses must simultaneously establish proper accounting systems, navigate complex tax incentives, manage investor expectations, and create financial projections with limited historical data. Early-stage companies often operate with restricted resources while making financial decisions with long-term implications for growth and valuation. These foundational choices establish patterns that support or hinder future development as companies move through funding rounds toward eventual maturity or acquisition.

Associating with the Dallas CPA firm during the formation stages provides start-ups with financial expertise typically unavailable within founding teams focused on product development and market entry. This professional guidance helps establish optimal business structures, implement scalable accounting systems, and maximize available tax incentives relevant to early-stage companies. The relationship creates financial discipline during critical formation phases, helping startups avoid common pitfalls that require costly corrections later. This foundation supports more efficient growth while creating financial credibility for attracting investment and partnership opportunities.

Entity structure advantages

The business entity selection represents one of the most consequential early decisions for startups, with implications affecting taxation, liability, investment structure, and eventual exit strategies. Professional guidance ensures founders experience the distinctions between LLCS, S-Corporations, C-Corporations, and other structures beyond superficial differences. These entity choices create long-term tax consequences, shape available fundraising methods, and establish governance requirements that persist throughout company development.

- Tax flow-through considerations – Different structures create varying tax implications for founders personally, particularly during early-stage losses typical in startup ventures

- Investment compatibility – Entity selection impacts available funding mechanisms, with specific structures better suited for venture capital or angel investment

- Equity compensation options – Various business structures offer different opportunities for stock options, restricted stock, profit interests, or other equity incentives

- Exit planning alignment – Initial entity decisions should align with long-term exit strategies, whether through acquisition, public offering, or ongoing private operation

These structural considerations extend beyond simple formation paperwork, creating financial frameworks that support or restrict future growth opportunities depending on initial decisions.

Financial credibility building

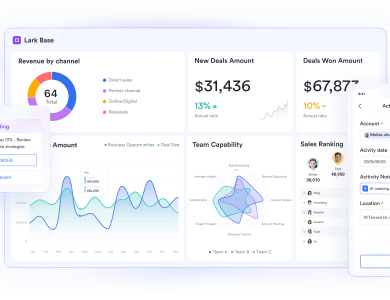

Startups seeking investment must establish financial credibility through proper accounting systems and professional financial reporting. Investors expect accurate financial statements, realistic projections, and transparent reporting that inspires confidence in management capabilities. Professional accounting relationships create this credibility through standardized financial statements, documented internal controls, and systematic record-keeping that satisfies investor due diligence requirements.Early accountings relationships help establish key metrics and performance indicators relevant to specific industries and business models. These customized measurements give founders critical insights for operational decisions while demonstrating analytical sophistication to potential investors. The resulting financial clarity improves both management effectiveness and fundraising success, establishing patterns of financial transparency that serve companies throughout their development lifecycle.

Runway maximization tactics

- Properly structured research and development activities can generate substantial tax credits for technical startups, even in pre-revenue stages

- Many states offer specific tax benefits for startups in targeted industries or geographic zones that require proper documentation

- Careful planning regarding when expenses occur can maximize tax benefits while aligning with fundraising timelines

- Professional projection models help startups manage critical runway timelines that determine future fundraising needs

These financial optimization strategies help emerging companies extend their operational runway between funding rounds. The resulting capital efficiency creates better valuation opportunities while reducing dilution pressures that often force premature fundraising under suboptimal terms. This financial discipline distinguishes well-managed startups from those without strategic financial guidance during critical early stages.